In each of these states, the cost of purchasing a home is relatively affordable when compared to other places in the country. The average price of a home in Mississippi is around $90,000, while the median price of a home in Arkansas is about $100,000. In Oklahoma, the average price of a home is around $120,000, while the median price of a home in Kentucky is around $130,000. Lastly, the average price of a home in West Virginia is around $140,000.

When compared to states like California, where the median price of a home is over $600,000, or New York, where the median price of a home is around $300,000, these five states are much more affordable options for those looking to purchase a home.

Of course, there are other factors to consider when choosing a state to live in besides the cost of purchasing a home. However, if you are looking for an affordable place to call home, these five states should definitely be at the top of your list.

According to Realtor.com, the cheapest state to buy a house in is West Virginia. The median home price in West Virginia is $129,900, which is much lower than the national median home price of $226,300. This makes West Virginia a great place for people who are looking to buy an affordable home.

Top 1 Cheapest State To Buy House is West Virginia

There are several reasons why West Virginia is the cheapest state to buy a house in. One reason is that the cost of living in West Virginia is very low. According to Sperling’s Best Places, the cost of living in West Virginia is 8.7% lower than the national average. This means that people who live in West Virginia can save a lot of money on everyday expenses.

Another reason why West Virginia is the cheapest state to buy a house in is that property taxes are very low. In fact, West Virginia has the second lowest property taxes in the country. This is great news for people who are looking to buy a home in West Virginia, as they will not have to pay a lot in property taxes.

If you are thinking about buying a house, then you should definitely consider West Virginia. You will be able to find a great deal on a home, and you will also save money on living expenses. Contact a real estate agent today and start your search for the perfect home in West Virginia.

The Best Cities to Buy a House in West Virginia

If you’re looking for the best city to live in West Virginia, look no further than Charleston. The capital city has something for everyone, from outdoor activities to a thriving nightlife scene. Here are just a few of the reasons why Charleston is the best city to live in West Virginia:

- The city has a low cost of living, with housing prices that are significantly lower than the national average.

- The unemployment rate in Charleston is also lower than the national average, making it a great place to find a job.

- Charleston is home to several colleges and universities, including the University of Charleston and West Virginia State University.

- The city has a variety of dining and shopping options, as well as a number of parks and other outdoor attractions.

- Charleston is located just a short drive from several major cities, including Washington, D.C., Baltimore, and Pittsburgh.

Whether you’re looking for a great place to raise a family or a lively city to call home, Charleston is the perfect choice. Come see why Charleston is the best city to live in West Virginia!

The Best Cities to Buy a House in Mississippi

If you’re looking for a place to call home in Mississippi, these three cities are definitely worth considering. Biloxi, Tupelo, and Gulfport offer residents a variety of amenities and activities to enjoy, as well as a great sense of community. Keep reading to learn more about what each of these top cities has to offer. There house prices are also affordable so you can in most cases need only 3,5% down to qualify for a mortgage in Mississippi.

Biloxi is a coastal city located in Harrison County, on the Mississippi Gulf Coast. The city is known for its beautiful beaches, seafood restaurants, and casino resorts. Biloxi is also home to several museums and historical sites, such as the Maritime & Seafood Industry Museum and the Beauvoir-The Jefferson Davis Home and Presidential Library.

Tupelo is the county seat of Lee County and is located in northeast Mississippi. The city is known as the birthplace of Elvis Presley and is also home to the Tupelo Automobile Museum, which houses a collection of over 100 vintage cars. Tupelo is a great place for nature lovers, with several parks and hiking trails located throughout the city.

Gulfport is the second largest city in Mississippi and is located in Harrison County, on the Gulf Coast. The city is known for its beautiful beaches, fishing charter boats, and seafood restaurants. Gulfport is also home to several museums, including the Lynn Meadows Discovery Center, which features interactive exhibits and hands-on activities for children.

All three of these cities offer residents a great quality of life. If you’re looking for a place to call home in Mississippi, be sure to check out Biloxi, Tupelo, and Gulfport

The Best Cities to Buy a House in Arkansas

If you’re looking for a place to call home in Arkansas, you won’t be disappointed with any of these top cities. From the lively capital city of Little Rock to the beautiful mountain town of Eureka Springs, there’s something for everyone in Arkansas.

Here are our top three picks for the best cities to live in Arkansas:

1. Little Rock

As the state capital, Little Rock is a vibrant and exciting place to live. There’s always something going on, whether it’s exploring the downtown area, hiking in one of the many nearby parks, or enjoying a show at the Arkansas Repertory Theatre. Plus, with a low cost of living and plenty of job opportunities, Little Rock is a great place to call home.

2. Eureka Springs

Nestled in the Ozark Mountains, Eureka Springs is a picturesque town that’s perfect for those who love the outdoors. From hiking and biking trails to fishing and canoeing, there’s no shortage of things to do in this beautiful setting. And, with a thriving arts community, there’s also plenty to do indoors as well.

3. Fayetteville

Fayetteville is a great place to live for those who want access to all the amenities of a big city but with a small-town feel. With a lively downtown area full of shops and restaurants, plus plenty of parks and trails for exploring, Fayetteville has something for everyone. And, with the University of Arkansas located here, there’s always a lively atmosphere in town.

The Best Cities to Buy a House in Oklahoma

Oklahoma is a great state to live in, with plenty of opportunity and Southern hospitality. If you’re looking for the best cities to live in Oklahoma, Tulsa, Oklahoma City, Edmond, Norman, Broken Arrow, Lawton, Enid, Stillwater, Midwest City, and Moore are all great choices. Each city has its own unique charm and amenities that make it a great place to call home.

Tulsa is the second largest city in Oklahoma and is known for its Art Deco architecture, world-renowned museums, and lively nightlife. The city also has a strong economy with plenty of job opportunities in a variety of industries.

Oklahoma City is the state capital and offers a lower cost of living than many other major cities. The city is also home to a number of top-rated museums, including the National Cowboy and Western Heritage Museum.

Edmond is a small city with a tight-knit community feel. The city is known for its excellent schools and beautiful parks and recreation areas.

Norman is home to the University of Oklahoma, making it a great place for students and faculty alike. The city also has a thriving arts and culture scene.

Broken Arrow is a growing city with a family-friendly atmosphere. The city offers a variety of activities for residents, including hiking, biking, and golfing.

Lawton is a military town with plenty of job opportunities at nearby Fort Sill. The city also has a number of parks and recreation areas for residents to enjoy.

Enid is a small city with a close-knit community feel. The city offers a variety of activities for residents, including hiking, biking, and golfing.

Stillwater is home to Oklahoma State University and has a lively college town atmosphere. The city also offers a number of dining and shopping options.

Midwest City is a suburb of Oklahoma City and is known for its family-friendly atmosphere. The city offers a variety of activities for residents, including hiking, biking, and golfing.

Moore is another suburb of Oklahoma City with a family-friendly atmosphere. The city has excellent schools and plenty of parks and recreation areas.

Top Cities to Buy a House in Kentucky

Lexington is the largest city in Kentucky and is known as the “Horse Capital of the World.” The city is home to the University of Kentucky, as well as many cultural attractions like the Lexington Opera House and Rupp Arena. Louisville, Kentucky’s largest metropolitan area, is located on the Ohio River and is home to several Fortune 500 companies. The city is also known for its championship horse racing track, Churchill Downs, and the Kentucky Derby.

Bowling Green is home to Western Kentucky University and Mammoth Cave National Park. The city has a thriving arts and culture scene, as well as a variety of outdoor activities to enjoy. Covington is located just across the river from Cincinnati, Ohio and is a great place to live if you’re looking for small-town charm with big-city amenities nearby. Owensboro is the third-largest city in Kentucky and is

known for its barbecue festival, which draws visitors from all over the world.

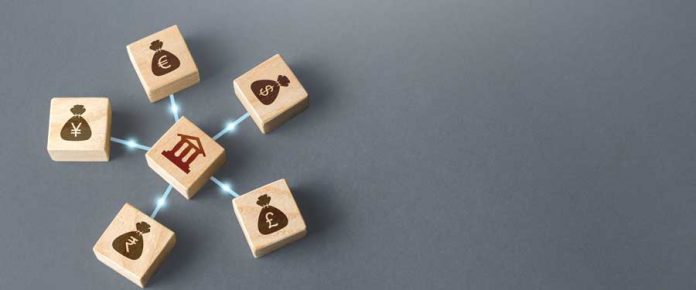

Buying a House in Kentucky and Applying for a Mortgage

mortgages in Kentucky are available from a variety of lenders. You can get a mortgage from a bank, a credit union, or a private lender. The type of lender you choose will affect the interest rate you get on your mortgage.

If you have good credit, you may be able to get a lower interest rate from a bank. If you have bad credit, you may have to pay a higher interest rate. Credit unions typically offer lower interest rates than banks.

Private lenders often charge higher interest rates than banks and credit unions. However, they may be willing to work with you if you have bad credit.

Before you apply for a mortgage, it’s important to compare rates from multiple lenders. This will help you get the best deal on your mortgage.

When you’re shopping for a mortgage, be sure to ask about fees and closing costs. These can add up, so it’s important to know what you’re paying before you agree to a loan.

If you’re considering a mortgage in Kentucky, be sure to shop around and compare rates from multiple lenders. This will help you get the best deal on your loan.

No matter what you’re looking for in a city, you’re sure to find it in Kentucky. These are just a few of the best places to call home in the Bluegrass State.